What is Long Term Care Insurance

Long-Term Care Insurance is a planning tool for Americans between the ages of 45-65, and with a net worth between $100,000 and about $3M.

How Much Money Should I Have?

If you have few assets (under $100k), there may not be a need to have an insurance policy to protect your assets, as the cost of the policy would outweigh the potential savings. On the other hand, if you have several million dollars, you’ll have enough in reserves to simply pay out of pocket without any measurable affect on your lifestyle. The fact is, Long Term Care Insurance is for the middle class.

What Does LTC Insurance Pay For?

Long Term Care Insurance policies pay for all sorts of care situations, so let’s go in-depth. While Medicare covers mostly medical-related services, people falsely believe that it will also cover “custodial” care.

Medicare

Medicare may cover limited services when you need Long Term Care, but the lion’s share of cost will be your responsibility. For example, Medicare may pay a nurse to come once or twice a week to prepare your medications for the week, but the administration of medications is not covered. Your doctor may determine that you are not able to manage your medications on you own, and you’d need someone to come to your home and assist. These are the kinds of things private insurance may pay for that Medicare may not.

Where Is Care Received?

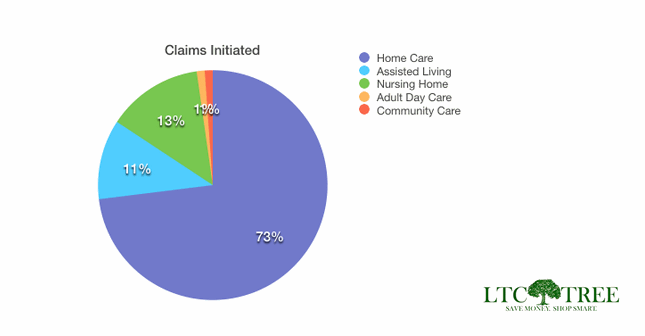

Most Long Term Care claims start at home. In fact, one large insurer reports that while 75% of claims started in the home, about 65% also ended in the home. Most policyholders never experienced having to enter a nursing home or assisted living.

How Much Does Long Term Care Cost?

We have a convenient cost of care map on the site that outlines what Long Term Care costs in your area. For the US in general, we see an average of about $40,000 a year for home care, $60,000 a year for assisted living, and about $90,000 a year for more intensive skilled nursing services.

How Much Does Long Term Care Insurance Cost?

The biggest factor in how much you’ll pay is your age and health. Buying at a younger age and in good health can reduce your costs by as much as 50%. We recommend starting your research as early as possible. Very good coverage can be purchased in your late 40s for as little as $1,500/year. Should you buy at an early age and then have an accident, the policy could pay benefits when you are younger, so having coverage in force at an earlier age has benefits. Request a quote on this site for your own personalized comparisons.

Supplemental Information

Additional information on What is Long Term Care Insurance.

Home Health Care makes up the majority of claims, and is where most claims start.

Did You Know?

Most policies have a 90-day waiting period before coverage starts, but for about 10% additional premium you can add an option that will waive your "elimination period" for home care. There are arguments for an against this rider, but it's something you should be aware of.

Request California Long Term Care Insurance Quotes Now.

Your free comparison quote includes:

1. LTC Report Card - Compare companies in California.2. Personalized Quotes Side-by-Side.

3. Product Brochures From Multiple Companies.

"We work hard to assist residents of California with their Long Term Care Insurance comparisons. We provide both traditional and HYBRID quote options, side-by-side. Give us a shot, you won't be disappointed.

Drew, Agent, San Deigo County California

Contact Us

3328 Avenida Anacapa

Carlsbad, CA 92008

P: (818) 452-4899

About Us | Privacy Policy

Copyright 2014-2018.